Portfolio Audit

A second opinion for your mutual fund investments

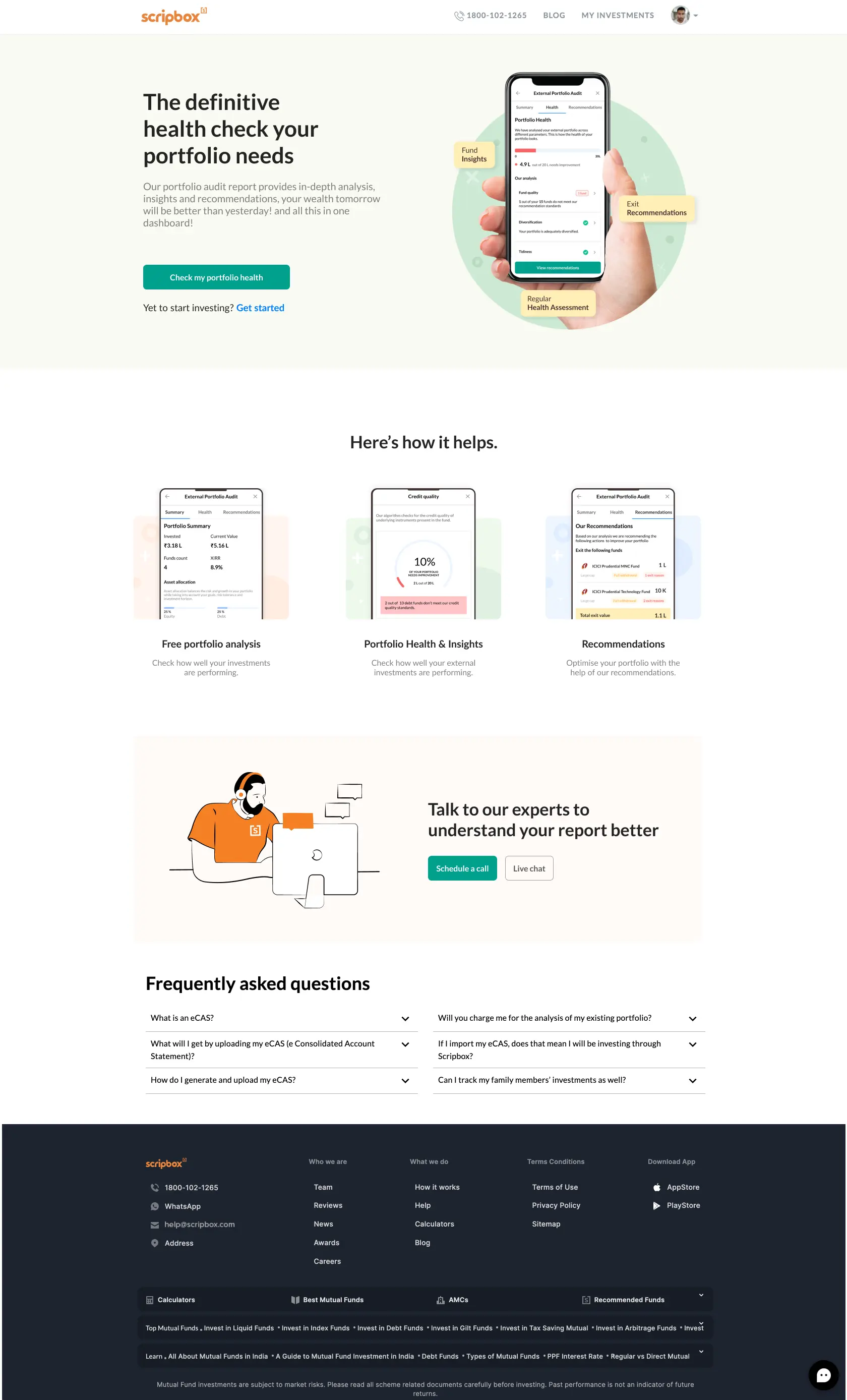

Overview

Portfolio Audit is a major feature that I worked on during my time at Scripbox. The purpose of this feature is to provide a comprehensive "second opinion" about the user's mutual fund portfolio, both within and outside of Scripbox.

The Problem

As part of the Share of Wallet product pod, the Product Manager, Jithu Gopal, and I were brainstorming about the various problems Scripbox faced when it came to increasing our share of wallet with our current customers. We set up calls with customers who also had mutual investments outside of Scripbox in order to better understand their needs and concerns.

Insights from Customer Interviews

- Mutual fund choices are often purely based on recommendations from family or friends and with no additional research or analysis.

- Fear of Missing Out (FOMO) is a major factor in decision-making

- Sunk cost fallacy is a major factor in decision-making

- They often get overwhelmed with financial jargon when trying to do their own research or talking to experts

- Whenever they get financial advice the WHYs are hardly ever explained.

- Many view advice cynically - "Perhaps you're recommending this only because your commissions will increase"

Based on these customer insights, we hoped to achieve the following objectives with this feature:

- Encourage users to add details of their external investments

- Provide a holistic view of the health of a user's portfolio

- Showcase and establish our financial expertise

- Build trust with our customers

- And, last but not the least, encourage them to move their investments to Scripbox

Competitor Analysis

I created accounts across many of our competitor apps in order to analyse and compare their flows and their approach to showing users' an overview of their portfolio. This ranged from ones where there was hardly any information provided to those that overwhelmed the user with a lot of information and jargon.

Comparing competitor flows and approach

Portfolio Audit Components

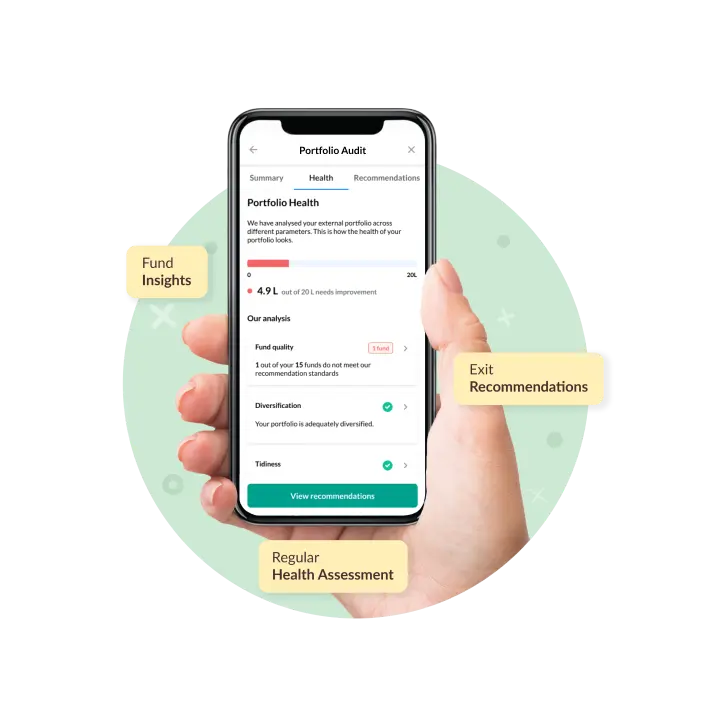

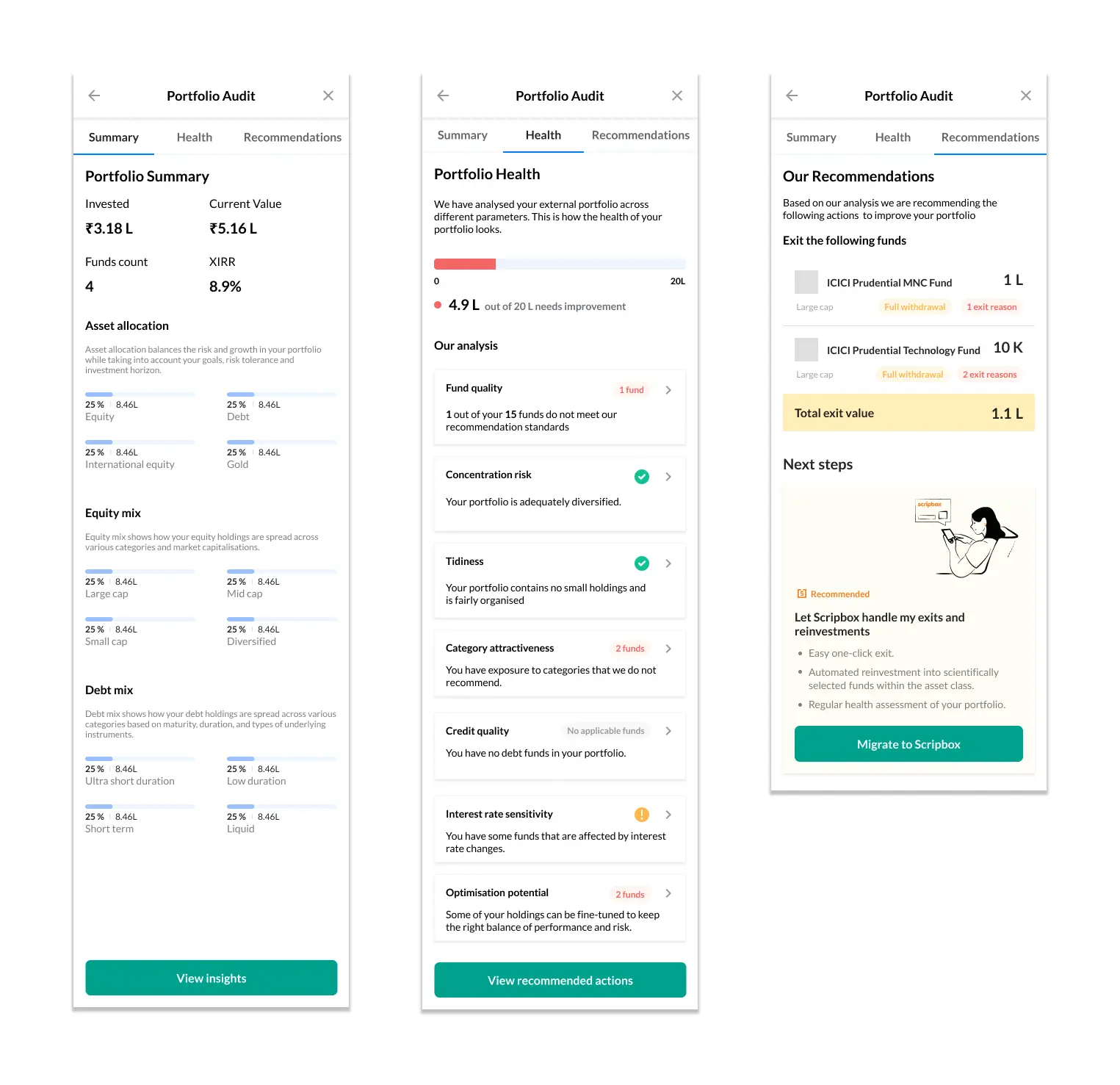

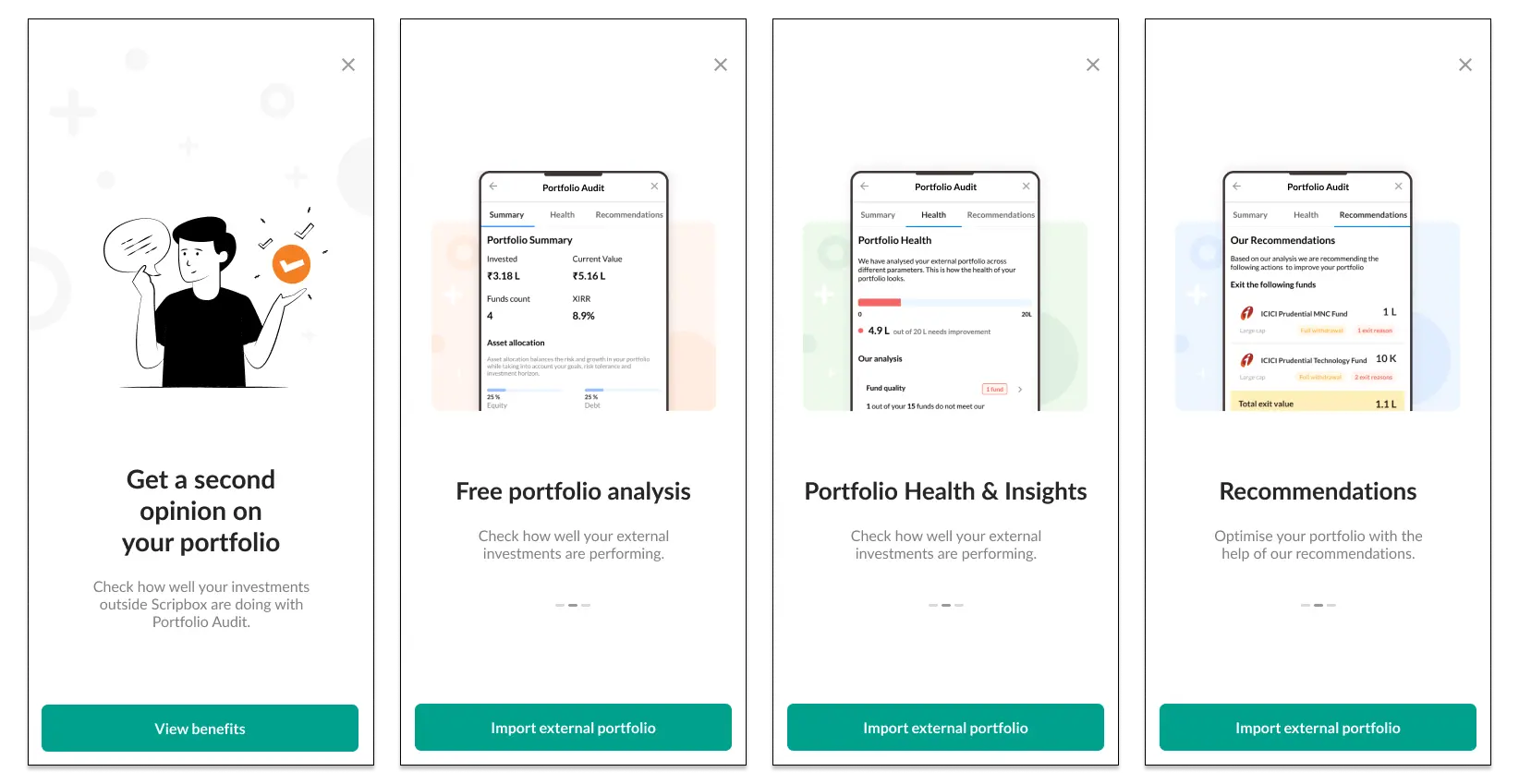

Our final Portfolio Audit report consists of 3 parts: Summary of holdings, Portfolio Health, and Recommended Actions.

Three parts of Portfolio Audit: Summary, Health, and Recommendations

Portfolio Health criteria

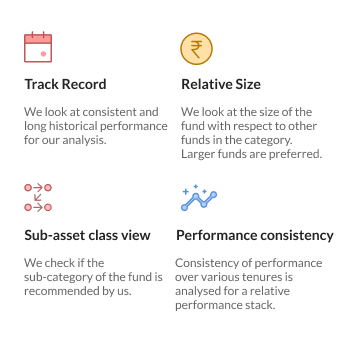

Based on inputs from our Investment Research team, their core criteria for evaluating mutual funds are as follows:

Criteria for Equity funds

Criteria for Debt funds

Using the above as a starting point, we came up a final list of 7 Portfolio Health criteria keeping in mind the need for even the most novice users to understand them. They are as follows:

- Fund Quality:

Our assessment of your fund quality based on our internal rating system driven by a proprietary algorithm.

- Concentration Risk:

Fund holdings that the user is over-concentrated in.

- Tidiness:

Fund holdings with small amounts that do not contribute meaningfully to the portfolio. We trim such positions to keep the portfolio organised.

- Category Attractiveness:

Equity funds are in categories where we don't have a favourable outlook.

- Credit Quality:

The credit quality of the underlying instruments present in the fund don't meet our quality standards.

- Interest Rate Sensitivity:

Relative interest rate risk of the fund sub category is high. We prefer funds that are not affected by interest rate changes.

- Optimisation Potential:

Fund positions that can be improved by moving to our recommended basket in a phased manner. These funds are not inherently bad but we believe this money can be managed better by keeping the right balance of performance and risk.

Portfolio Health

Portfolio Health details

For the individual health criteria, we had the ensure that the detail page had enough information to convey the exact reason that a fund had to be replaced but also make sure that we do not overwhelm the users with excessive details. For this purpose, we had to make use of progressive disclosure and split the information into collapsible sections and auxiliary screens. That way those who just wanted information at a glance could get what they needed up-front but the more knowledgeable users could click through to view deeper analysis.

Diving deeper into a Portfolio Health criterion

Identifying and handling states

We identified 4 primary states for portfolio, along with 5 combination states which are a combination of 2 or more of the primary states

PRIMARY STATES

- Action Required: Portfolio contains poor quality mutual funds that user needs to redirect their funds from.

- No Action Required: Healthy portfolio that requires no changes.

- Monitored Funds: No immediate action required but certain funds are being monitored by our team and might require action later.

- No Analysis Available: This means that either there is no applicable fund for the particular analysis criteria or that the Scripbox investment research team has not analysed and rated the fund yet.

COMBINATION STATES

- Action Required + Monitored States

- Action Required + No Anaylsis (Unrated Funds)

- No Action Required + No Anaylsis (Unrated Funds)

- Monitored Funds + No Anaylsis (Unrated Funds)

Handling all the possible states

Marketing webpage and in-app information screens

Marketing webpage

In-app info screen